Related Blogs

February 2, 2021 | Michael Reilly

There’s something brewing under the surface with respect to the U.S. Sector rankings that may surprise you – I know it surprised me!

There’s something brewing under the surface with respect to the U.S. Sector rankings that may surprise you – I know it surprised me!

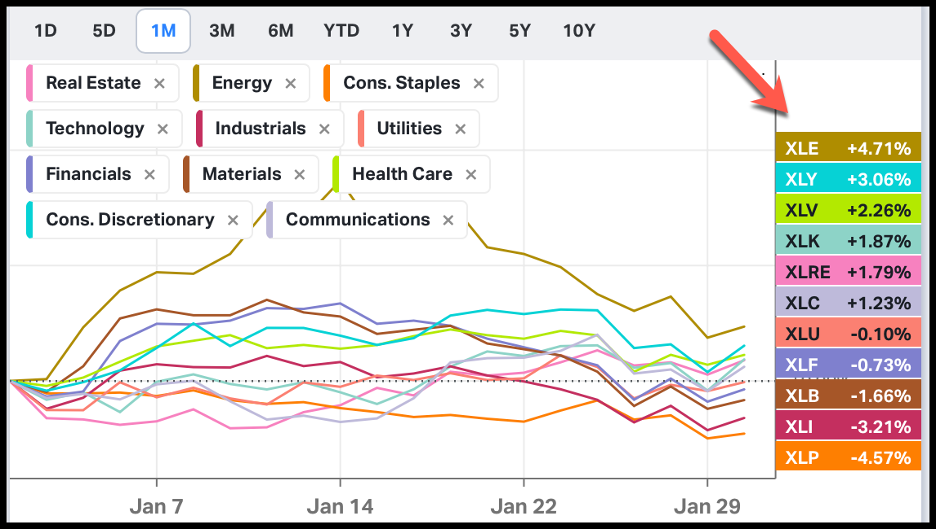

While Consumer Cyclicals and Technology remain the strongest sectors out of the 11 broad U.S. sectors we track here at Rowe Wealth Management, #1 and #2 respectively, what’s interesting is a former lagger that’s emerging, or should I say, re-emerged, as a relative strength leader.

I’m not sure if you’re aware, but the Energy sector is a perennial laggard – a real snooze fest for most investors. It’s not unusual to find the sector ranked dead-last in our annual ranking of sector performance.

However, today the Energy sector finds itself in the top half of sector rankings – in the #3 spot, with Materials, Healthcare and Industrials not far behind.

Energy moved from the eighth-ranked sector to the third-ranked on its way to becoming the most improved sector over the past month.

And what do I often say about a sector that outperforms on a relative strength basis? Well, that it usually outperforms on an absolute basis as well.

And that’s exactly what our Energy sector proxy – XLE has done. Over the last month the Energy sector is up +4.71%, more than doubling the return of the highest ranked sector – Technology +1.87%.

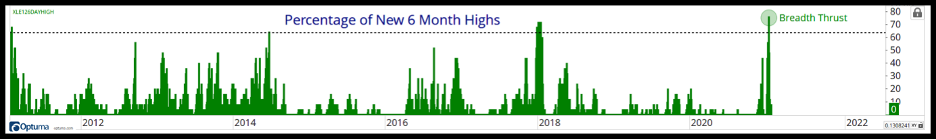

And if that’s not enough, XLE just printed a breadth thrust in its percentage of stocks hitting new 6-month highs – a very bullish sign indicating a lot of stocks in the energy sector all hitting new 6 month highs.

I’m just as surprised as anyone, but we can only interpret the data that’s in front of us… and right now, it looks bullish for Energy.

And let me say, this isn’t just any extreme reading, more Energy stocks are making new highs right now than they have at any time in the past decade! Crazy right!

The green line in the chart represents the percentage of stocks in the Energy Sector making new highs.

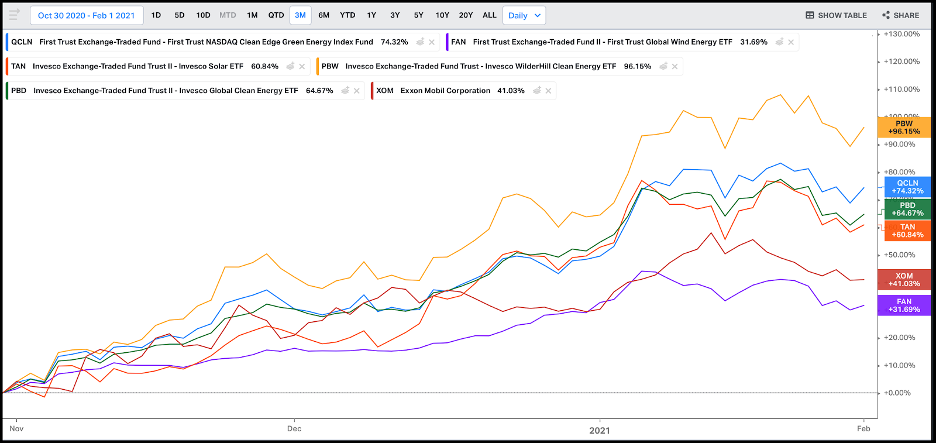

Alternative energy and the clean energy space have gotten most of the attention over the past year, with some serious market beating returns.

And they haven’t slowed down – just look how they’ve done over the last 3 months:

However, it’s not just the “Alt’s” that are showing strong gains, even some of the more traditional energy companies like Exxon Mobil are presenting a positive technical picture and strong returns – up 41% since October 30, 2020.

Those are some pretty impressive gains out of a perennial laggard.

Here’s a list of some of the alternative energy ETFs ranked highly in our Energy sector matrix.

First Trust Clean Energy ETF QCLN.

Invesco Solar Energy Fund TAN.

Invesco Wilderhill Clean Energy PBW.

Invesco Global Clean Energy Fund PBD.

First Trust Global Wind Energy FAN.

Make sure you dig in and take a look at the top holdings of some of these for some potential trade ideas.

Until next week, invest wisely!

Tags

Get Our FREE Guide

How to Find the Best Advisor for You

Learn how to choose an advisor that has your best interests in mind. You'll also be subscribed to ADAPT, Avalon’s free newsletter with updates on our strongest performing investment models and market insights from a responsible money management perspective.